Lagos DMO Holds Annual Staff Retreat on Innovation, Sustainable Financing of Infrastructure

The Lagos State Debt Management Office recently held its Annual Staff Retreat with the theme: “Exploring Alternative Debt Instruments for Infrastructure Development: Social, Diaspora & Environmental Impact Bonds.”

The event, attended by key dignitaries and special guests, focused on leveraging innovative financing mechanisms to meet the burgeoning infrastructure needs of Lagos State.

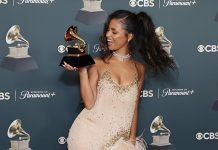

Welcoming Participants and acknowledging the presence of esteemed Special Guests, the Permanent Secretary, Debt Management Office (DMO), Mrs. Alake Sanusi expressed gratitude for their support.

Among the distinguished attendees were: Managing Director, Chapel Hill Denham Advisory Services, Mrs. Kemi Awodeyin, Chief Executive Officer/Managing Director STL Trustees, Mrs Funmi Ekundayo, Managing Director, UTL Trustees, Mrs. Olaide Osaro, Managing Director, SAMTL Trustees, Mr. Friday Omayebu, and Project Consultant/Managing Director, Voda Infrastructure Management Limited Mr. Akindeji Akinniranye.

Also joining the Honourable Commissioner for Finance, Mr. Oluyomi Abayomi, to welcome our esteemed Special Guests were high-ranking State Government Officials, among who are, the Special Adviser to the Governor on Corporate Finance and Strategic Investment, Mr. Akintayo Sanwo-Olu, the State Accountant General/Permanent Secretary, State Treasury Office, Dr. Abiodun Muritala, Permanent Secretary, Local Government, Chieftaincy Affair & Rural Development, Mrs. Kikelomo Bolarinwa.

In her address, the Permanent Secretary (DMO) outlined the Agency’s significant milestones in deploying diverse debt financing strategies to meet the State’s infrastructure needs across multiple Sectors. She noted the need for innovative financing tools beyond traditional debt instruments in light of rapid urbanization and volatile economic climate. Social, diaspora, and environmental impact bonds present groundbreaking opportunities to mobilize resources while ensuring that developmental initiatives generates both economic and measurable social and environmental benefits. She noted that strategic initiatives and robust financial management practices had upgraded the State’s credit rating from Aa+ to AAA by Fitch Ratings. Furthermore, she announced that the Lagos State is on the verge of issuing its first Green bond, a historic move as the first sub-national government in Nigeria.

While enjoining Participants to maximize the opportunity to gain new knowledge, she stated that the resource persons and facilitators leading the sessions were carefully selected for their expertise as their insights and experiences will undoubtedly enrich our understanding and inspire actionable strategies aligned with the retreat’s theme. She equally leverage on this platform to inform the Attendees that the State is on the verge of issuing first Green bond, which will also be the first ever embarked on by a sub-national government in Nigeria.

In his Keynote address, the Honorable Commissioner for Finance, Mr. Oluyomi Abayomi, described the Retreat as a vital forum to reflect, strategize, and reaffirm the critical role of the Debt Management Office (DMO) in shaping the State’s financial future. He underscored the urgency of embracing innovative financial sources to support a rapidly growing population and the increasing pressure on critical infrastructure.

He emphasized that “The Retreat is not just about theoretical discussions; it is about laying a practical roadmap for the Lagos State’s alternative financial model. We must ensure accountability and transparency so that every kobo borrowed is utilized efficiently for Lagosians. The need for innovation in alternative financial sources is imperative and must be pursue with vigor’’.

Declaring the Retreat open, the Honourable Commissioner, commended the DMO’s effective management of the State’s debt profile and urged Participants to fully engage, share insights, challenge conventional thinking, and develop actionable strategies to position Lagos as a model of innovative financing in Africa.

Other dignitaries in attendance praised the professionalism of the DMO and encouraged active participation throughout the retreat.

In her closing remarks, Ms. Titi Awokoya, Director Admin. and Human Resource, Debt

Management Office, expressed sincere appreciation to all the dignitaries, participants and various Committee members for their presence and support. She reaffirmed the commitment of the DMO workforce to upholding dedication and loyalty to the State’s leadership, with a steadfast focus on achieving even greater milestones in the future.